Maximum Sep Contribution For 2025. Use the interactive calculator to calculate your maximum annual retirement contribution based on your income. $19,000 in 2019), plus an.

Can an s corp have a sep ira? To be eligible to participate in an employer’s sep ira, the irs says employees must be at least 21 years old, have worked at the business for three of the.

Choosing The Best Small Business Retirement Plan For Your Business, Sep ira contribution limit calculator. Employer contributions to a sep.

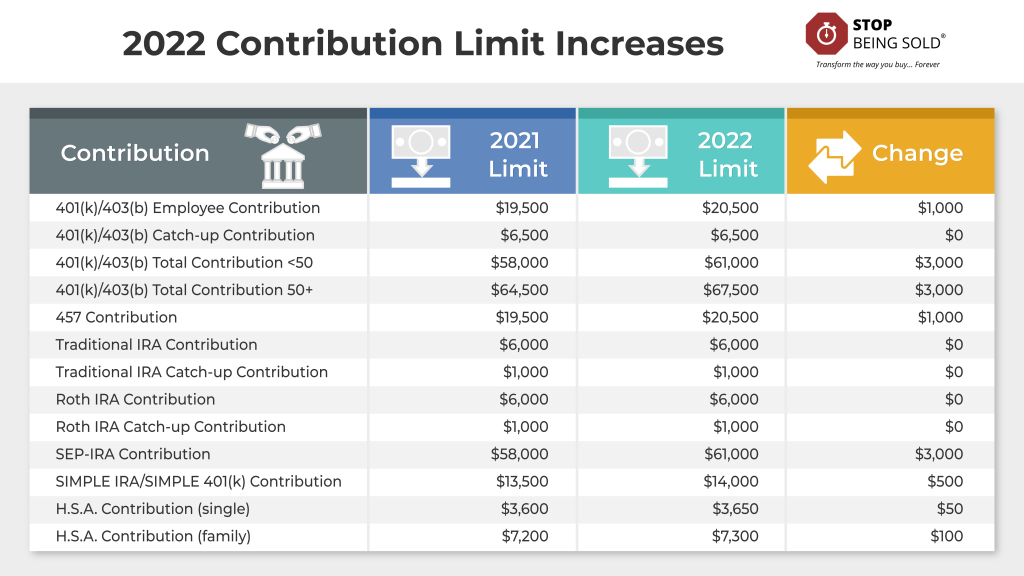

Simplified Employee Pension (SEP) Contribution Limits & Rules, Beginning in 2025, the ira contribution limit is increased to $6,500 ($7,500 for individuals age 50 or older) from $6,000 ($7,000 for individuals age 50 or older). $66,000 in 2025 and $69,000 in 2025

Sep contribution calculator WajehaEason, In 2025, employers can contribute a maximum of 25% of each accountholder’s annual pay or $61,000, whichever is less. From a day job (whole dollars, no.

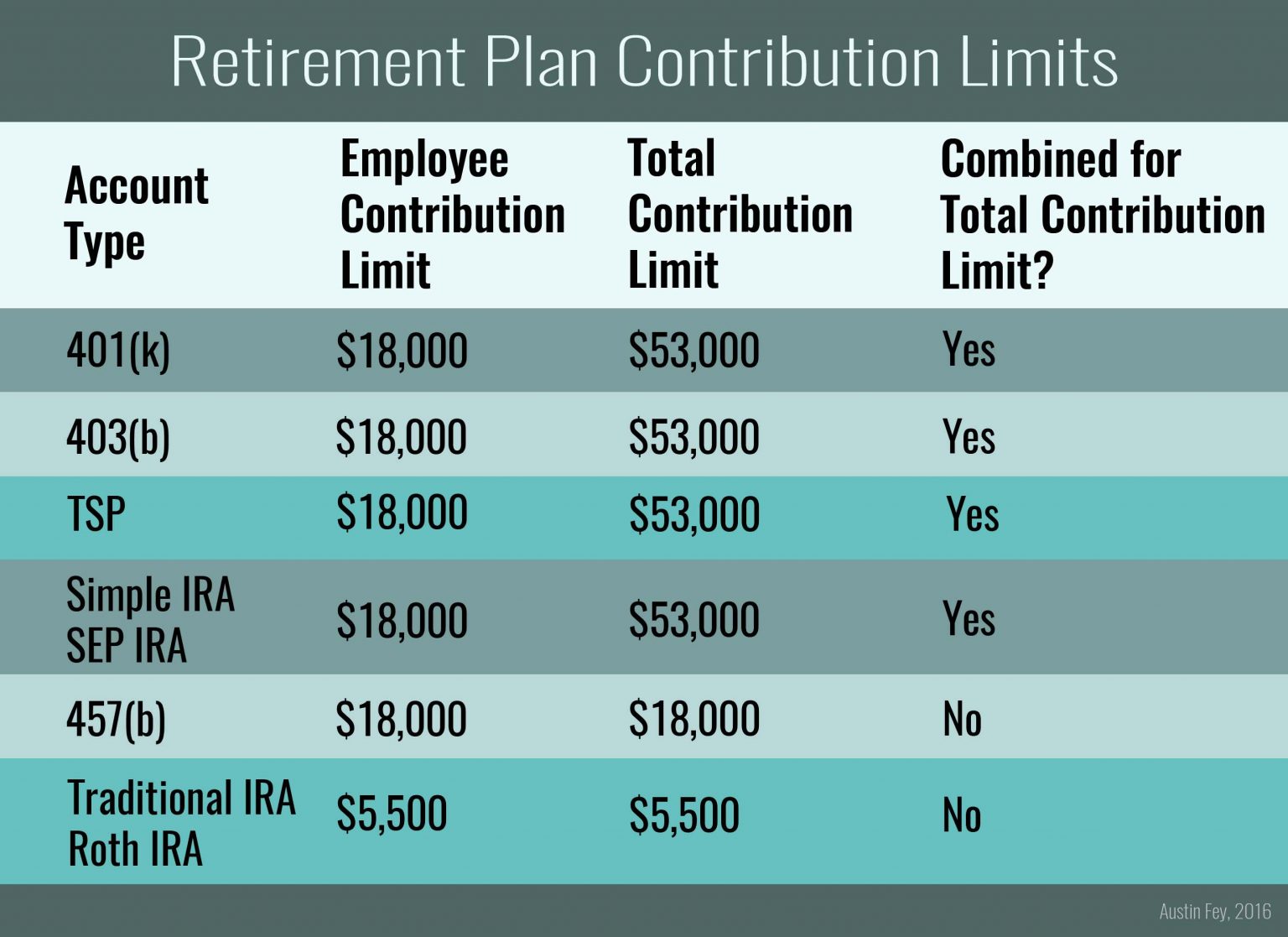

SelfEmployed? How to Choose Between a Solo 401(k) & SEPIRA Retirement, Up to $330,000 of an employee’s compensation may be considered. Employers can deduct payments to a simplified employee pension (sep) ira for one or more employees up to set limits.

%26 SEP IRA Self-Employed Retirement Plan Contributions.png?width=1200&name=Solo 401(k) %26 SEP IRA Self-Employed Retirement Plan Contributions.png)

Sep 2025 Contribution Limit Irs Ceil Meagan, How much can i contribute into a sep ira? See the contribution limits for your plan.

How to calculate SEP IRA contributions for self employed YouTube, Contribution deadline for sep iras. The sep ira maximum contribution limit is the lesser of:

Sep Ira Contribution Limits 2025 Over 50 Janey Lisbeth, $66,000 in 2025 and $69,000 in 2025 Can an s corp have a sep ira?

Sep ira calculator growth AnjieKhayla, Contribution deadline for sep iras. Use the interactive calculator to calculate your maximum annual retirement contribution based on your income.

Maximum SEP Contribution In Powerpoint And Google Slides Cpb, Use the interactive calculator to calculate your maximum annual retirement contribution based on your income. $69,000 in 2025 ($66,000 in 2025) unless you annually earn $345,000 in 2025.

Sep Contribution Limits 2025 Over 50 Norry Antonina, Employer contributions to a sep. In 2025, employers can contribute a maximum of 25% of each accountholder’s annual pay or $61,000, whichever is less.